With the current state of the Global Economy and with interest rates being at low levels the expectation is that this will continue for sometime.

What are the options for clients seeking income returns?

Cash Rates

Currently the top cash rate around is with RABO Direct and UBank.com.au who are offering around the 5.6% and 5.71% respectively. As with most banks conditions do apply.

Rabo Direct – offers 5.6% for deposits up to $250,000 for a 4 month period.

UBank.com.au – offers 5.71 for deposits up to $200,000 and if you make a regular deposit of $200 per month.

We also have access to some good term deposit solutions so please contact the office if you wish to discuss these further.

Government Bonds and Corporate Bonds

In very simple terms a bond is an IOU created by a Government or Business check out our article on Bonds here.

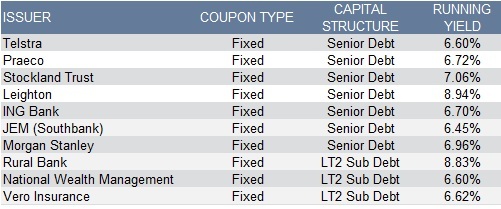

There are a number of different options for investment into bonds however there are limits with regards to the minimal value you can invest, with most around the $50,000 level. As an indication check out the below income returns on some of the bonds which are available on the market:

** The above are indicative only

The Economists View?

Dr Shane Oliver talks about the search for yield in a world of falling interest rates. He takes a look at what this means for bank deposits, alternative sources of yield, sticking to your investment strategy, and what it all means for investors.