Last night Treasurer Jim Charmers announced his second Federal Budget. The Federal Budget is a plan for how things will be spent and focus on what the Federal Government see’s as priorities as well as being a great transparency in our democratic system.

Last night Treasurer Jim Charmers announced his second Federal Budget. The Federal Budget is a plan for how things will be spent and focus on what the Federal Government see’s as priorities as well as being a great transparency in our democratic system.

Labor’s second Budget has pointed to ongoing inflationary pressures, higher interest rates than what Australians have recently been used to and some “strains” within the financial sector, he walked on a tightrope: presenting us a budget surplus (in the short term) while suggesting the outlook was far less rosy. Australia’s economic growth is predicted to fall to 1.5 per cent next financial year and only recover to 2.25 per cent the year after. This comes despite a $125.9 billion improvement in the budget over five years and saving a huge $83 billion in interest over the next 12.

Central to the cost of living focus were power bill relief for more than five million low income families, and a $2.2 billion increase to medicines on the PBS. All Australians on JobSeeker will receive an extra $40 per fortnight, and those aged 55 and over will now have access to increased payments that will bring them inline with those above 60. Medicare will be bolstered with a $3.5 billion injection that will enable more free consultations to a further 11.6 million people.

The stage 3 tax cuts for 2024 are unchanged and the well discussed changes to Superannuation which were announced in March this year, with the Government plans to reduce the tax concessions available to individuals with a total superannuation balance exceeding $3 million, from 1 July 2025.

For small business, there was the extension of the $20,000 instant asset write off, green subsidies to incentivise investment in power-saving opportunities and some initiatives to help SMEs adopt digital technologies.

As always before any of these announcements can be implemented, they will require passage through parliament. It is likely the super changes will have support from all sides of politics but we will update you as these change.

Overview

We have prepared a summary of the key measures for Individuals, Superannuation, Social Security and for Companies below:

-

Exempting lump sum payments in arrears from the Medicare levy – The Government will exempt eligible lump sum payments in arrears from the Medicare levy from 1 July 2024. This measure will ensure low-income taxpayers do not pay higher amounts of the Medicare levy as a result of receiving an eligible lump sum payment, for example as compensation for underpaid wages. To qualify, taxpayers must be eligible for a reduction in the Medicare levy in the 2 most recent years to which the lump sum accrues. Taxpayers must also satisfy the existing eligibility requirements of the existing lump sum payment in arrears tax offset, including that a lump sum accounts for at least 10 per cent of the taxpayer’s income in the year of receipt.

-

increasing the Medicare levy low-income thresholds – The Medicare levy low-income thresholds for singles, families, seniors and pensioners will increase from 1 July 2022. The increase in thresholds provides cost-of-living relief by taking account of recent CPI outcomes so that low-income individuals continue to be exempt from paying the Medicare levy. The threshold for singles will be increased from $23,365 to $24,276. The family threshold will be increased from $39,402 to $40,939. For single seniors and pensioners, the threshold will be increased from $36,925 to $38,365. The family threshold for seniors and pensioners will be increased from $51,401 to $53,406. For each dependent child or student, the family income thresholds will increase by a further $3,760 instead of the previous amount of $3,619.

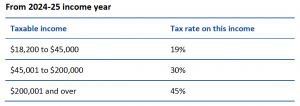

- No Changes to the Stage 3 Tax Cuts which have already been legislated to start from the 2023-24 income year and will change Marginal Rates As Follows:

Also remember these From the ‘Mini’ Budget Last Year.

- Amendment to the Electric Car Discount – The Government will remove the eligibility of plug-in hybrid electric cars from the fringe benefits tax exemption for eligible electric cars. This change will apply from 1 April 2025. Arrangements involving plug-in hybrid electric cars entered into between 1 July 2022 and 31 March 2025 remain eligible for the Electric Car Discount.

- From Mini Budget – Electric Car Discount and FBT Exemptions for certain electric vehicles. A car benefit is an exempt fringe benefit (i.e. not subject to FBT) if:

- the car is a zero or low emission vehicle (i.e. battery electric vehicles, hydrogen fuel cell electric vehicles and plug-in hybrid electric vehicles)

- the car is first held and used on or after 1 July 2022, and

- the value of the car at the first retail sale (GST inclusive) was below the luxury car tax threshold for fuel efficient vehicles ($84,916 in 2022/23 tax year). In other words, if the luxury car tax is applicable, the car benefit cannot be an exempt fringe benefit and FBT is payable.

- Expanding Paid Parental Leave (PPL) from 2024 with two additional weeks and expansion by 2026 to 26 weeks. Currently, the PPL scheme is comprised of two payments for eligible carers of a newborn or recently adopted child. PPL is available for up to 18 weeks for the birth parent, while Dad and Partner Pay is available for up to two weeks to fathers and partners.

From 1 July 2023, the Government will provide a total 20-week payment to families, including a portion reserved for each parent on a “use it or lose it” basis. Single parents will be able to access the full 20 weeks. The Government will introduce reforms from 1 July 2023 to make PPL flexible for families. If they meet eligibility criteria:- either parent is able to claim the payment, and

- both birth parents and non-birth parents with a newly adopted child are allowed to receive the payment.

Parents will also be able to claim weeks of the payment concurrently, so they can take leave at the same time. To further increase flexibility, from July 2023 parents will be able to take Government-paid leave in blocks as small as a day at a time, with periods of work in between, so parents can use their weeks in a way that works best for them. Eligibility will be expanded through the introduction of a $350,000 family income test, under which families can be assessed if they do not meet the individual income test currently set at $156,647.

- Targeted Super Concessions – As announced in March, the Government will reduce the tax concessions available to individuals with a total superannuation balance exceeding $3 million, from 1 July 2025.

Individuals with a total superannuation balance of less than $3 million will not be affected. It will bring the headline tax rate to 30 per cent, up from 15 per cent, for earnings corresponding to the proportion of an individual’s total superannuation balance that is greater than $3 million. Earnings relating to assets below the $3 million threshold will continue to be taxed at 15 per cent, or zero per cent if held in a retirement pension account. Interests in defined benefit schemes will be appropriately valued and will have earnings taxed under this measure in a similar way to other interests. This will ensure commensurate treatment. The measure will not place a limit on the amount of money an individual can hold in superannuation. The current contribution rules continue to apply.

-

Securing Australians’ Superannuation Package – increasing the payment frequency of the Superannuation Guarantee (SG) and investing in SG compliance From 1 July 2026, employers will be required to pay their employees’ SG entitlements on the same day that they pay salary and wages. Currently, employers are only required to pay their employees’ SG on a quarterly basis. By increasing the payment frequency of superannuation to align with the payment of salary and wages, this measure will both ensure employees have greater visibility over whether their entitlements have been paid, and better enable the ATO to recover unpaid superannuation. Increased frequency of payment will also support better retirement outcomes. Changes to the design of the SG charge will also be necessary to align with increased payment frequency. The Government will consult with relevant stakeholders on the design of these changes, with the final design to be considered as part of the 2024–25 Budget.

-

Increase to Working Age Payments – The Government will increase support for people receiving working age payments including the JobSeeker Payment. This measure will:increase the base rate of working age and student payments by $40 per fortnight. This increase applies to the JobSeeker Payment, Youth Allowance, Parenting Payment (Partnered), Austudy, ABSTUDY, Disability Support Pension (Youth), and Special Benefit. It will commence on 20 September 2023 extend eligibility for the existing higher single JobSeeker Payment rate for recipients aged 60 years and over, to recipients aged 55 years and over who are on the payment for 9 or more continuous months. The increased support for recipients aged 55 years and over, the majority of whom are women, acknowledges the additional challenges older Australians face in re-entering the workforce, such as age discrimination or poor health.

-

Increased Support for Commonwealth Rent Assistance Recipients – The Government will increase the maximum rates of the Commonwealth Rent Assistance (CRA) allowances by 15 per cent to help address rental affordability challenges for CRA recipients.

-

Energy Price Relief Plan – The Government will allocate $1.5 billion over two years from 2023–24 to establish the Energy Bill Relief Fund. This Fund will support targeted energy bill relief to eligible households and small business customers, which includes pensioners, Commonwealth Seniors Health Card holders, Family Tax Benefit A and B recipients and small business customers of electricity retailers.

- Improving Aged Care Support, home care, and funding model – The Government will introduce a new hoteling supplement of $10.80 per resident per day by separating out the existing hoteling component of the Australian National Aged Care Classification (AN-ACC) price (the $10 Basic Daily Fee Supplement) starting 1 July 2023. The Government will also adjust the care minute allocations within the AN-ACC funding model from 1 October 2023 to better align care minutes with resident needs. The Government will provide:

-

- $487.0 million over 4 years from 2023–24 (and $133.6 million ongoing) to extend, and make ongoing, the Disability Support for Older Australians Program.

- $41.3 million over 4 years from 2023–24 (including $11.9 million in capital funding from 2022–23) to build a new place assignment system, allowing older Australians to select their residential aged care provider.

- Additional funding to improve the in-home aged care system, including $166.8 million in 2023–24 to release an additional 9,500 Home Care Packages.

Remember the announcements from the Mini Budget:

- Increased timeframe for those downsizing to hold funds from 12 months to 24 months with reduced deeming rates. As previously announced, the Government has proposed an extension to the assets test exemption of principal home sale proceeds that are intended to be spent on purchasing a new home from 12 months to 24 months for social security income support recipients. In addition, during the asset test exemption period, the Government will apply the lower deeming rate of 0.25% to the principal home sale proceeds. This measure aims to reduce the financial impact on pensioners looking to downsize their homes in an effort to minimise the burden on older Australians and free up housing stock for younger families.

-

Small Business Support – $20,000 instant asset write-off – A temporary extension of the instant asset write-off threshold of $20,000, from 1 July 2023 until 30 June 2024. Small businesses with aggregated annual turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets. Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15 per cent in the first income year and 30 per cent each income year thereafter.

-

Small Business Support – Small Business Energy Incentive – The Government has extended support for small and medium businesses to save on energy bills through incentivising the electrification of assets and improvements to energy efficiency. Small and medium businesses (those with aggregated annual turnover of less than $50 million), will be able to deduct an additional 20 per cent of the cost of eligible depreciating assets that support electrification and more efficient use of energy. Up to $100,000 of total expenditure will be eligible for the Small Business Energy Incentive, with the maximum bonus deduction being $20,000. A range of depreciating assets, as well as upgrades to existing assets, will be eligible for the Small Business Energy Incentive. These will include assets that upgrade to more efficient electrical goods such as energy efficient fridges, assets that support electrification such as heat pumps and electric heating or cooling systems, and demand management assets such as batteries or thermal energy storage. Eligible assets will need to be first used or installed ready for use between 1 July 2023 and 30 June 2024. Eligible upgrades will also need to be made in this period. Certain exclusions will apply such as electric vehicles, renewable electricity generation assets, capital works, and assets that are not connected to the electricity grid and use fossil fuels.

-

Driving Collaboration with Small Business to Reduce the Time Spent Complying with Tax Obligations There will be additional ATO funding to lower the tax-related administrative burden for small businesses, including:; $12.8 million over 3 years from 2023–24 to trial an expansion of the ATO independent review process to small businesses (with aggregated turnover between $10 million and $50 million) subject to an ATO audit. The trial will commence on 1 July 2024 and run for 18 months. 9 May 2023; $9.0 million over 4 years from 2023–24 (and $1.4 million per year ongoing) for 5 new tax clinics from 1 January 2025 to improve access to tax advice and assistance for 2.3 million small businesses.

-

Additional reforms aiming to cut paperwork and reduce the time small businesses spend doing taxes include; From 1 July 2024, small businesses will be permitted to authorise their tax agent to lodge multiple Single Touch Payroll forms on their behalf, reducing paperwork for small businesses. From 1 July 2024, small businesses will benefit from faster, safer and cheaper income tax refunds by reducing the use of cheques. from 1 July 2025, small businesses will be given up to 4 years to amend their income tax returns, reducing the burden of making revisions.

Seek out further advice and start your journey to being free around your money and creating wealth with understanding.

Scott Malcolm has been awarded the internationally recognised Certified Financial Planner designation from the Financial Planning Association of Australia and is Director of Money Mechanics. Money Mechanics is a fee for service financial advice firm who partner with clients in Melbourne, Canberra and Sydney to achieve their life and wealth outcomes. Money Mechanics Pty Ltd (ABN 64 136 066 272) is a Corporate Authorised Representative (No. 336429) of Infocus Securities Australia Pty Ltd (ABN 47 097 797 049) AFSL and Australian Credit Licence No. 236523

The information provided on this article is of a general nature only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information you should consider its appropriateness having regard to your own objectives, financial situation and needs.