Last night the Albanese Government announced it’s first adjustments to the Federal Budget. The Federal Budget is a plan for how things will be spent and focus on what the Federal Government see’s as priorities as well as being a great transparency in our democratic system.

Last night the Albanese Government announced it’s first adjustments to the Federal Budget. The Federal Budget is a plan for how things will be spent and focus on what the Federal Government see’s as priorities as well as being a great transparency in our democratic system.

Labor’s first Budget was filled with measures aimed at easing the cost of living over the coming years, addressing the challenges of a slowing economy, and introducing investments designed to place Australia in a stronger position for the future. For superannuation and tax, the announcements were mainly re-commitments from earlier Budgets (so no big changes here). This includes the change to the eligibility age for downsizer contributions. The stage 3 tax cuts for 2024 are also unchanged. Instead of focusing on super and tax, most of the proposals centred around investing into key sectors and infrastructure, and providing affordable housing for more Australians through a new national Housing Accord.

As always before any of these announcements can be implemented, they will require passage through parliament. It is likely the super changes will have support from all sides of politics but we will update you as these change.

Overview

We have prepared a summary of the key measures for Individuals, Superannuation, Social Security and for Companies below:

- Increased funding for tax office compliance (tax avoidance, shadow economy and multinationals)

- Electric Car Discount and FBT Exemptions for certain electric vehicles. A car benefit is an exempt fringe benefit (i.e. not subject to FBT) if:

- the car is a zero or low emission vehicle (i.e. battery electric vehicles, hydrogen fuel cell electric vehicles and plug-in hybrid electric vehicles)

- the car is first held and used on or after 1 July 2022, and

- the value of the car at the first retail sale (GST inclusive) was below the luxury car tax threshold for fuel efficient vehicles ($84,916 in 2022/23 tax year). In other words, if the luxury car tax is applicable, the car benefit cannot be an exempt fringe benefit and FBT is payable.

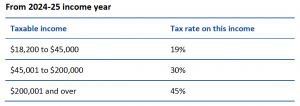

- No Changes to the Stage 3 Tax Cuts which have already been legislated to start from the 2023-24 income year and will change Marginal Rates As Follows:

- Paid Family and Domestic Violence Leave (with small business support to implement once legislated – this is current in the Senate)

- Childcare subsidy increases to 90% for those earning under $80,000 per year and tapering out for family incomes under $530,000 per year. Child Care Subsidy (CCS) rates will lift from 85% to 90% for families earning less than $80,000. CCS rates will then taper down one percentage point for each additional $5,000 in income until it reaches 0% for families earning $530,000 or more. Families will continue to receive existing higher subsidy rates for the second and subsequent children aged five and under in care, up to 95%. The higher CCS rates will cease 26 weeks after the older child’s last session of care, or when the child turns six years old. The ACCC will be tasked to undertake a 12-month inquiry into the cost of child care and the Productivity Commission to conduct a comprehensive review of the child care sector. Large child care providers will be required to report CCS-related revenue and profits in a bid to improve the transparency of the child care sector

- Expanding Paid Parental Leave (PPL) from 2024 with two additional weeks and expansion by 2026 to 26 weeks. Currently, the PPL scheme is comprised of two payments for eligible carers of a newborn or recently adopted child. PPL is available for up to 18 weeks for the birth parent, while Dad and Partner Pay is available for up to two weeks to fathers and partners.

From 1 July 2023, the Government will provide a total 20-week payment to families, including a portion reserved for each parent on a “use it or lose it” basis. Single parents will be able to access the full 20 weeks. The Government will introduce reforms from 1 July 2023 to make PPL flexible for families. If they meet eligibility criteria:- either parent is able to claim the payment, and

- both birth parents and non-birth parents with a newly adopted child are allowed to receive the payment.

Parents will also be able to claim weeks of the payment concurrently, so they can take leave at the same time. To further increase flexibility, from July 2023 parents will be able to take Government-paid leave in blocks as small as a day at a time, with periods of work in between, so parents can use their weeks in a way that works best for them. Eligibility will be expanded through the introduction of a $350,000 family income test, under which families can be assessed if they do not meet the individual income test currently set at $156,647.

- Downsizer contribution (sale of primary residence) with funds up to $300,000 can now start from age 55 (this was reduced to age 60 in the last Federal Budget).

- Deferring Residency Test for SMSF members and trustees

- Removal of 3 year audits for SMSF (annual audits will still be required by Self Managed Super Funds)

- Increased Threshold for Commonwealth Seniors Health Card. As previously announced, the Government has proposed increasing the income threshold for the Commonwealth Seniors Health Card from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples. Legislation implementing this measure is currently before Parliament. It was initially proposed to commence 20 September 2022. However, due to delays in passing the legislation, the commencement date is now proposed to be 7 days after the legislation receives Royal Assent..

- From 1 January 2023 the Government will decrease the general patient co-payment for treatments on the Pharmaceutical Benefits Scheme from $42.50 to $30.00.

- Increased timeframe for those downsizing to hold funds from 12 months to 24 months with reduced deeming rates. As previously announced, the Government has proposed an extension to the assets test exemption of principal home sale proceeds that are intended to be spent on purchasing a new home from 12 months to 24 months for social security income support recipients. In addition, during the asset test exemption period, the Government will apply the lower deeming rate of 0.25% to the principal home sale proceeds. This measure aims to reduce the financial impact on pensioners looking to downsize their homes in an effort to minimise the burden on older Australians and free up housing stock for younger families.

- Continued Work Bonus with people able to earn up to $11800 before pension is reduced. As previously announced, the Government will provide a once-off increase to the Work Bonus income bank of $4,000 for Age and Veteran Pensioners. The temporary increase to the income bank will increase the amount pensioners can earn in 2022–23 from $7,800 to $11,800, before their pension is reduced.

- Boosting funding for aged care residence and access to nurses

- The Government will provide further response to the Aged Care Royal Commission with new measure to improve the quality of the system. What was announced (or reconfirmed) in tonight’s mini-Budget?

- Care minutes and registered nurses – average care minutes will increase in two stages, with 200 care minutes per resident per day (including 40 nursing minutes) from 1 October 2023 and increasing to 215 care minutes (including 44 nursing minutes) from 1 October 2024. From 1 July 2023 all residential care services will need to have a registered nurse on site at all times, unless an exemption has been granted. These increases in staff costs, will be supported with additional $2.5 billion of government funding.

- Better food – Maggie Beer has campaigned for, and trained aged care catering staff on how to provide, better and more nutritional food. The Maggie Beer Foundation will be granted $5 million to support these activities.

- National registration scheme – national registration for personal care workers will be established, including a code of conduct, better employment pathways, ongoing training and English proficiency training.

- Capping home care fees – administration and management fees on home care packages are proposed to be capped, with exit fees abolished, to ensure more of the home care package is available to fund direct care services.

- In-home care services – the government remains committed to merging the Commonwealth Home Support Program and Home Care Packages into a single in-home care program, but this has been deferred by a further year to 1 July 2024 to allow further consultation.

- New complaints process – a dedicated Aged Care Complaints Commissioner will be re-established (previously combined into the Quality and Safety Commission) and a new independent Inspector-General of Aged Care will be established to target systemic administration and governance issues with an aim to improve outcomes for clients.

- Small Business well-being mental health and financial counselling support.

- Changes to Off Market Share Buy Back programs to align the tax to that of ‘on-market’ transactions. This may adjust how corporate actions are managed by companies. At the moment this could result in larger franking credits being available to investors rather than paying capital gains. This measure will remove the ability to trigger the corporate action on the income account.

Seek out further advice and start your journey to being free around your money and creating wealth with understanding.

Scott Malcolm has been awarded the internationally recognised Certified Financial Planner designation from the Financial Planning Association of Australia and is Director of Money Mechanics. Money Mechanics is a fee for service financial advice firm who partner with clients in Melbourne, Canberra and Sydney to achieve their life and wealth outcomes. Money Mechanics Pty Ltd (ABN 64 136 066 272) is a Corporate Authorised Representative (No. 336429) of Infocus Securities Australia Pty Ltd (ABN 47 097 797 049) AFSL and Australian Credit Licence No. 236523

The information provided on this article is of a general nature only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information you should consider its appropriateness having regard to your own objectives, financial situation and needs.