The Government has released its comprehensive plan for tackling climate change and secure a clean energy future with the release of a carbon tax.

The carbon tax will be payable by around 500 of the biggest polluters in Australia. To assist households with price impacts there will be tax cuts and increases in pensions, allowances and benefits.

A significant tax reform will mean that over 1 million individuals will no longer need to file a tax return.

After the Federal Budget announcement in May 2011 I mentioned it was the first time in 9 years we had not seen any tax cuts, but it seem the Government was keeping these in their back pocket to help smooth over the introduction of the Carbon Tax.

The Government has fixed the carbon tax price at $23 a tonne for the first three years after which it will then be determined by the market.

The carbon tax will be introduced on 1 July 2012.

The Government has announced that the average household increase in living will be $9.90 per week but through the compensation package they will receive an average of $10.10 per week, so that they are $0.20 per week better off. The compensation package for Australian consumers will include:

- pensioners and self-funded retirees will get up to $338 extra per year if they are single and up to $510 per year for couples (combined);

- families receiving Family Tax Benefit Part A will get up to an extra $110 per child per year ;

- eligible families will get up to an extra $69 in Family Tax Benefit Part B per year ;

- allowance recipients will get up to $218 extra per year for singles, $234 per year for single parents and $390 per year for couples combined;

- taxpayers with annual income of under $80,000 will all get a tax cut, with most receiving at least $300 per year ;

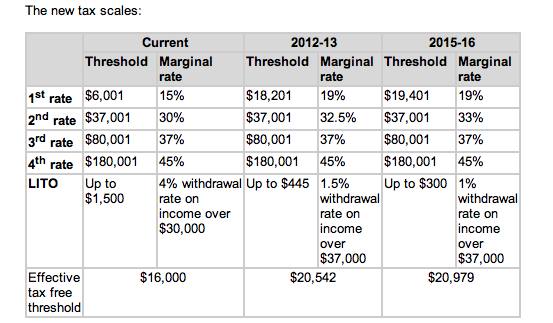

- the tax-free threshold will increase from $6,000 to $18,200 which will also include an increase from 15% to 19%, and the next tax bracket from 30 to 33% ;

- the Low Income Tax Offset (LITO) will reduce from $1,500 to $445 ; and

- the new effective tax free threshold will rise from $16,000 to $20,542.

To find out more about the Government’s carbon tax, please click on the link below to the Clean Energy Future website

Impact to your current strategies

As the Government has announced changes to the low to medium income brackets, this may affect some of your planning strategies.

Below is a general outline on some of these changes:

- If you are salary sacrificing into superannuation, down to taxable income of $20,542, but make sure you stay within your individual concessional contributions cap. Currently the ’salary sacrifice to super’ rule of thumb to minimise taxation is to salary sacrifice down to taxable income of $30,000, to maximise the Low Income Tax Offset (LITO). The main reason for the reduction in the taxable income level is because of the increase in the first marginal tax rate from 15% to 19% and the reduction in the Low Income Tax Offset.

- Consider reviewing your salary packaging setup and structure as these changes may increase the benefit to package a concessional benefit, such as car, especially after the changes announced in the 2011 Federal Budget to car fringe benefits.

- If you earn over $37,000 per year you will now be paying a higher rate of tax of 32.5% for 2012/13 and the 33% from 2015-16 income year. However, the company and an investment bond rates remain at a flat 30% (29% for companies if other tax reforms eventuate).

MM Comment: These are the initial announcements made by the Government on Sunday and still have to be passed through parliament so they may change slightly. Once finalised it would be a good time to review strategies before the start of the 2012- 2013 income year – we still have time on our side for that one!

Scott Malcolm (scott@money-mechanics.com.au) is Director of Money Mechanics (ph: 6257 5557) a fee for service advice firm who are authorised to provide financial advice through PATRON Financial Advice AFSL 307379.

The information provided on this article is of a general nature only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information you should consider its appropriateness having regard to your own objectives, financial situation and needs.