Do you want to make sure you can live your lifestyle today when you get to retirement?

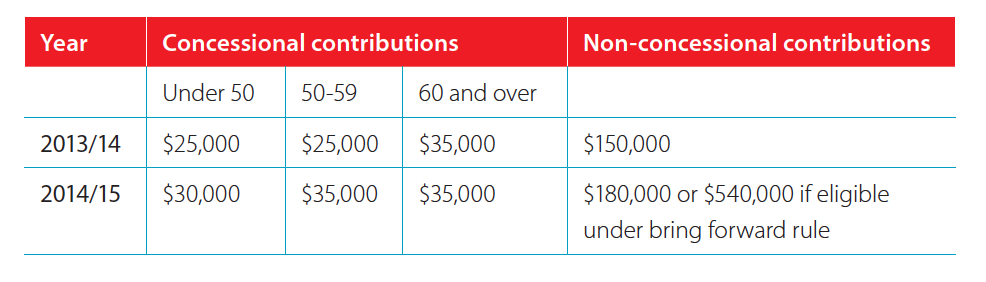

Well, now you can! For the first time in five years, for people under 50, the limits that regulate the amount you can contribute to super (on a concessionally taxed basis) has increased. That is, if you are under 50 from 1 July 2014, you can contribute $30,000 a year to your super (up from $25,000). If you are 50 or over during 2014/15, you can contribute up to $35,000 a year (increased from $25,000).

So, if you’re worried that your super guarantee (SG) contributions alone may not afford you the lifestyle you want in retirement, then why not start contributing more to your super? Depending on your age, you can contribute up to $10,000 more a year. Remember, your concessional contributions include both SG and salary sacrifice contributions and are taxed at the concessional rate of just 15 per cent compared to your marginal rate.

Note: If you earn more than $300,000 in taxable income, then the 30 per cent contribution tax rate may apply.

Case study – how to reap the benefits

Let’s have a look at how the new contribution limits can help you save for retirement.

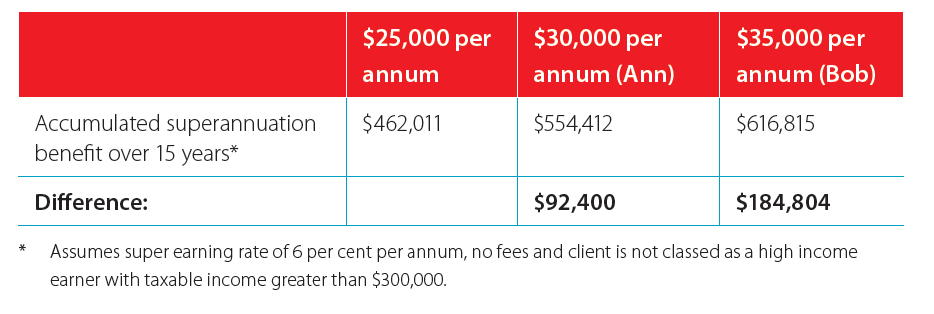

Over the last five years, Ann (aged 40) and Bob (aged 50) have both been maximising their concessional contributions limits and contributing $25,000 (via both SG and salary sacrifice strategies) into their respective super funds.

Under the new rules, Ann can now contribute an extra $5,000 to her super each year and Bob can contribute an extra $10,000 to his super each year.

The following table shows the difference these additional contributions (non-indexed over 15 years) would make to their retirement nest egg.

As you can see, it’s a substantial amount – $92,400 for Ann and $184,804 for Bob.

There’s also another opportunity to contribute more to super. As the ‘non-concessional’ contribution cap is set at six times the standard concessional contribution cap, from 1 July 2014, this cap also increased up to $180,000 per year. Also, if you’re aged 64 or younger, you may be eligible to bring forward the next two years of non-concessional contributions in 2014/15 — increasing the cap to $540k.

Non concessional contributions are after-tax contributions and include personal contributions to super for which you have not claimed a tax deduction.

If you’re considering contributing more to super, now is the time to take action. If you want to talk about how this strategy might work for you, please speak to us today.